What is a Limited Edition?

In the art world, an edition refers to an original artwork that is conceived as a numbered series. The edition size can either be open or fixed beforehand by the artist. Typically, the creation process begins with a unique artwork such as a master surface, mold, or cast, from which the editions are reproduced.

Limited editions are created in a fixed series of multiple numbers, and the artist and producer/editor carefully choose the edition size beforehand. It’s important to note that once the edition is complete, no more reproductions can be created. The concept of a “limited edition” is essential for collectors who seek to differentiate between an authentic numbered print and an offset open or unlimited edition. To further establish the authenticity of the work, editions are often signed and numbered by the artist, with each numbering noted as a fraction of the total edition run. This provides collectors with a guarantee of the work’s authenticity.

Types of Limited Editions

Prints

The most common types of printmaking are lithographs, etchings, screen prints, woodcuts and digital prints.

Sculptures

Sculptures can be made of different materials such as bronze, glass, stone, porcelain, raisin, etc.

Photographs

Photographs can be printed using various techniques such as c-print, giclée print, inkjet print, gelatin silverprint etc.

“Parallel to the expansion of online supplies and the increasing number of new market participants, a significant increase in sales of limited editions can be observed.”

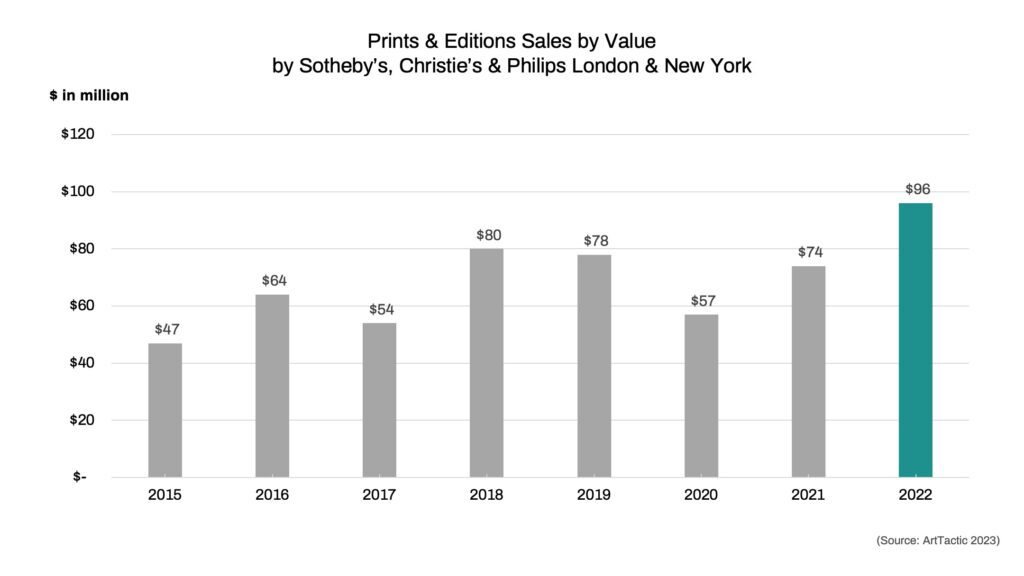

Auction results data from Sotheby’s, Christie’s, Phillips & Bonhams for years 2019-2022

Why could Limited Editions be a Good Investment?

The limited editions market is still considered a niche market, however in the past years it has grown exponentially.¹ In 2022, about $95.5 million worth of modern and contemporary prints and editions were sold in auction sales at Sotheby’s, Christie’s and Phillips. This corresponds to 30% higher sales than in 2021, 66% higher than in 2020, and even 20% increased compared to the pre-covid sales of $79 million – showing how the demand for prints and editions keeps rising strongly.² Since 2015 the market has grown with an average annual rate of 14.12%. This trend also resulted in auction houses increasing their editions auctions. For example Phillips went from 4 to 7 editions sales in 2022, after a 45% rise in the prints and editions sales volume compared to 2020.³ Similarly, Christie’s New York has also witnessed a significant uptake in demand, resulting in a 40% increase in sales of editions.⁴

A set of core attributes makes limited editions suitable to buy for value preservation as well as for a possible increase in value: limited editions are authentic works, sold at a lower price point that is inclusive to a larger audience. Moreover, they are more frequently available on the market, allowing for transparency around price volatility. Lastly, limited editions are more liquid and tradable, resulting in a dynamic market environment. All these factors contribute to a greater financial control and democratization of such luxury assets.

Parallel to the expansion of online supplies and the increasing number of new market participants, a significant increase in sales of limited editions can be observed. Within the last ten years, both the number of auction transactions and the sales revenue from prints have doubled.⁵

1 Myartbroker.com, Mid-Year Review report, 2022

2 Art Tactic Prints Report, p. 4

3 Liveart.io, Phillips Adds Editions Sales to Meet Strong, Article, February 9, 2022

4 LiveArt, 2022

5 Artprice.com, The Art Market, 2022, p. 11